Weekly Market Report

2024/8/2 31th week

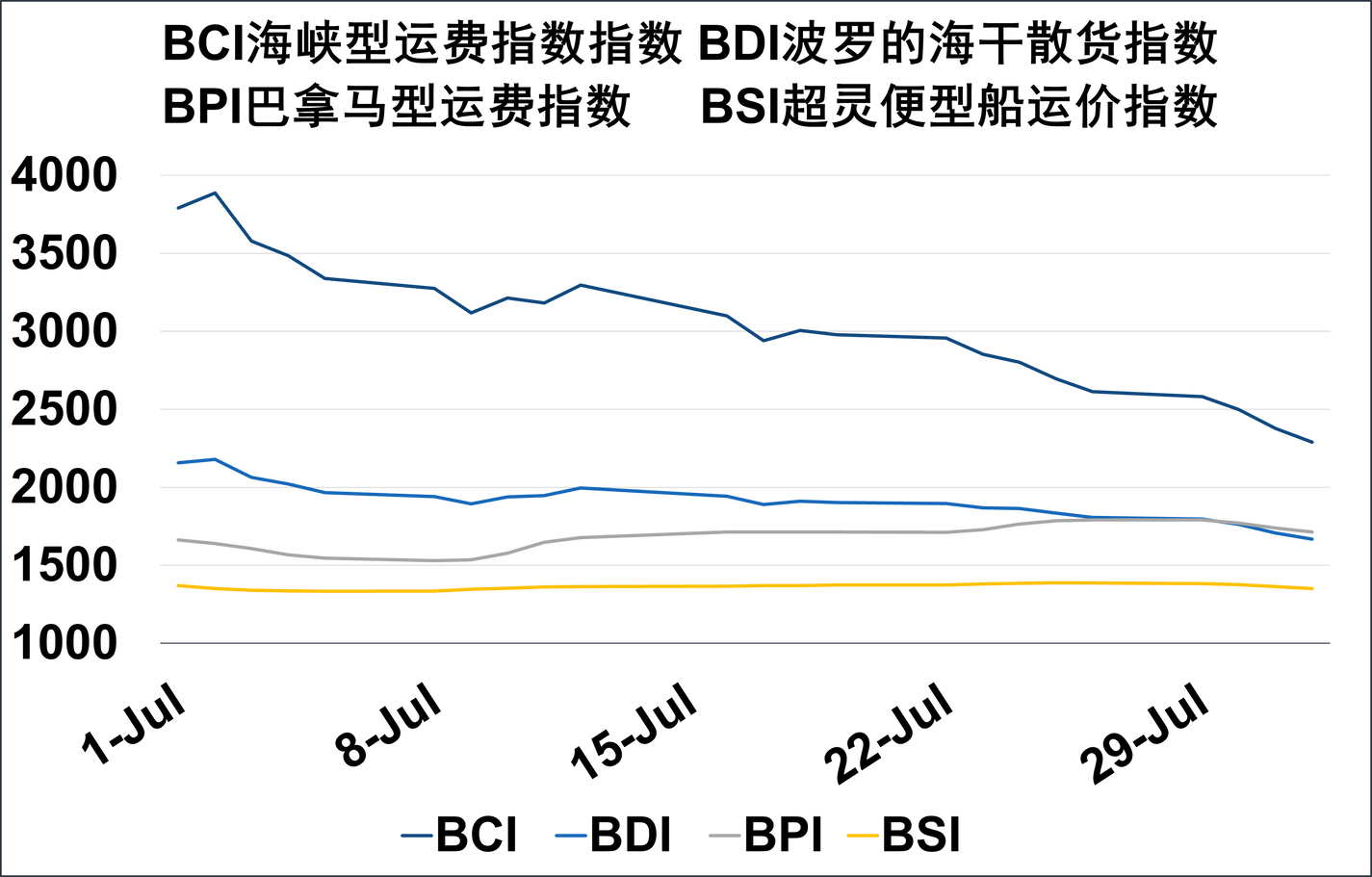

Baltic Dry Index

Bunker price

ContiOcean

ContiOcean

ContiOcean

ContiOcean

oTHER Index

ContiOcean

ContiOcean

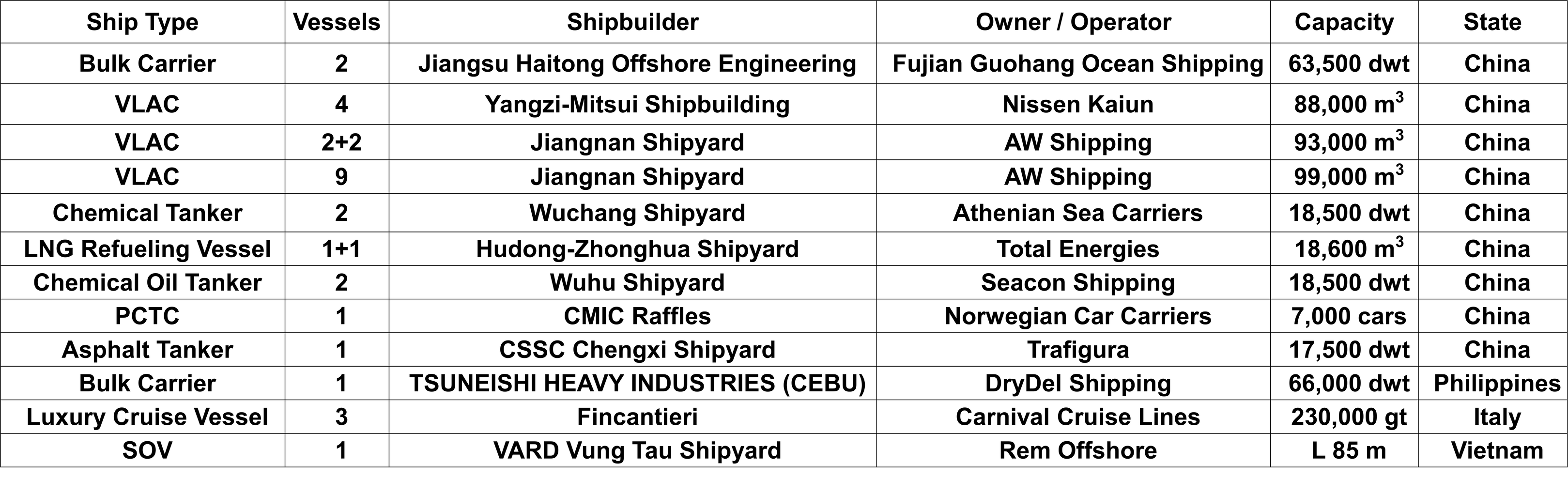

新船订单跟踪 Newbuilding Orders (7.22-7.28)

ContiOcean

ContiOcean

News Cornor

Market News

- 建700米长超大型船坞?新时代造船投巨资升级扩产

New Times Shipbuilding invests heavily in upgrading and expanding production, and plans to build a

700-meter-long super-large dry dock.

The latest global shipbuilding industry monthly report was released, with volumes and prices rising

simultaneously: 179 new orders were signed globally in June 2024.

- 352艘订单再创新高!中韩船厂为法国“独角兽”打工?

The French shipyard GTT received 58 new ships and held orders for 352 ships, setting a new high.

Market News from Lloyd’s list

WSC refines IMO carbon price proposal

World Shipping Council proposes a proportional carbon price for vessels failing a 65% emissions reduction than fossil fuels.

Many carbon price proposals will be on the table at MEPC82 as member states must make progress to adopt mid-term measures in 2025.

GREENHOUSE GAS INTENSITY OF FUELS WOULD BE CALCULATED ON A FULL LIFECYCLE, ALSO CALLED WELL-TO-WAKE, BASIS UNDER WSC’S PROPOSAL.

Source: Hasenpusch Photo